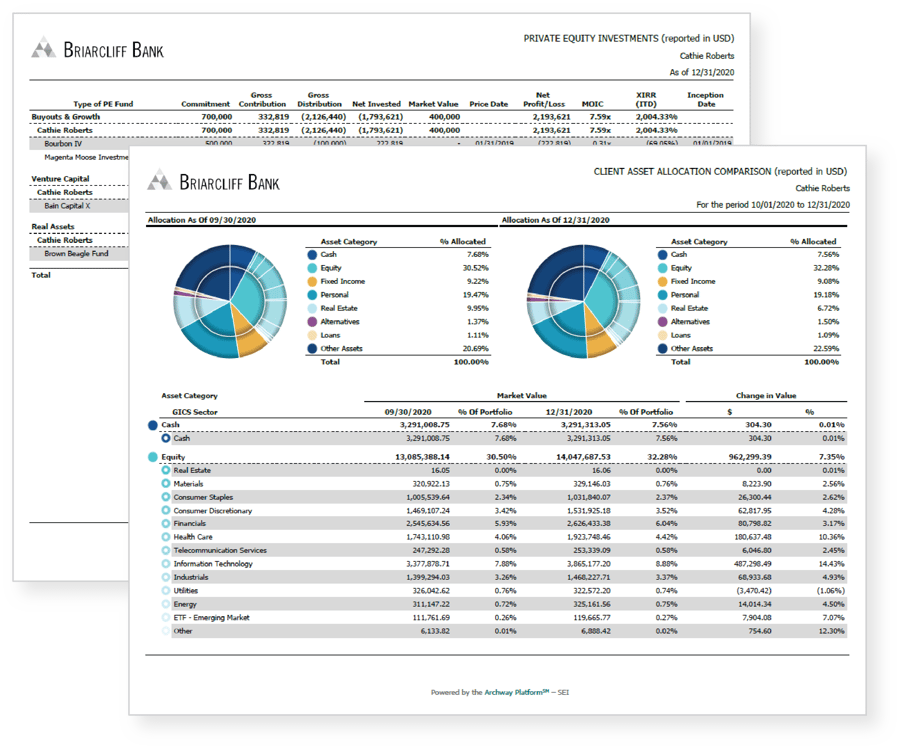

Enterprise-Grade Technology and Service Solutions

Private Banks

As clients demand greater transparency and access to their financial information, private banks and other large financial institutions are seeking ways to optimize and streamline their client experience. Archway Family Office Services offers a suite of enterprise-grade technology and award-winning outsourced service solutions that help global financial institutions and their advisors deliver a consolidated view of their high-net-worth clients' accounts and investments.

Learn how our technology and service solutions can help you differentiate your client service offering

.png?width=400&name=Portal_Performance%20Comparison%20Dark%20Mode%20(tablet).png)