A Scalable Data Aggregation and Client Reporting Solution

Private Wealth Advisory Firms

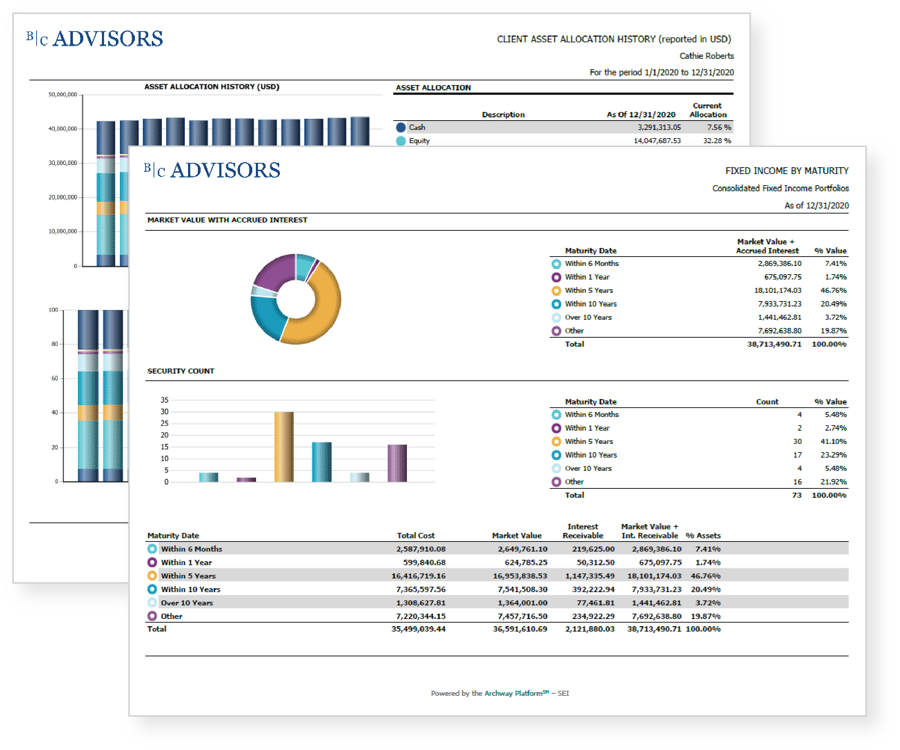

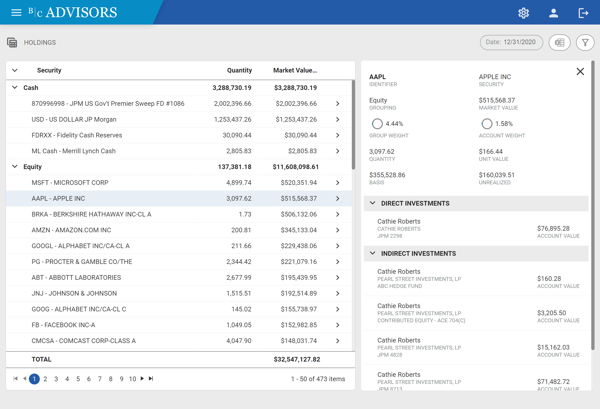

Amid a highly competitive high-net-worth advisory market, RIAs and wealth advisors are being pressed to differentiate and evolve their investment advisory services. Whether you're looking to personalize your high-net-worth client experience, modernize your technology stack, streamline your reporting operations or offer bespoke concierge services, Archway Family Office Services allows you to combine the rich functionality of the Archway PlatformSM with a suite of award-winning outsourced services to create a unique high-net-worth financial advisory solution.

Learn how our solutions can help you better manage and report on high-net-worth client wealth